deferred sales trust problems

In this article well walk you through Deferred Sales Trust DST advantages and opportunities and compare pros and cons with the 1031 exchange. Deferred Sales Trusts provide an alternative to 1031 exchanges for deferring capital gains taxes on appreciated assets.

Deferred Sales Trust Oklahoma Bar Association

Deferred sales trust vs 1031 for a 7 part video series to breakdown the differences.

. This gives investors the opportunity to take less risk. Deferred Sales Trust DST looks like a tax conceptArguably it is but thats not all. Dennis Walker yes the deferred sales trust is real.

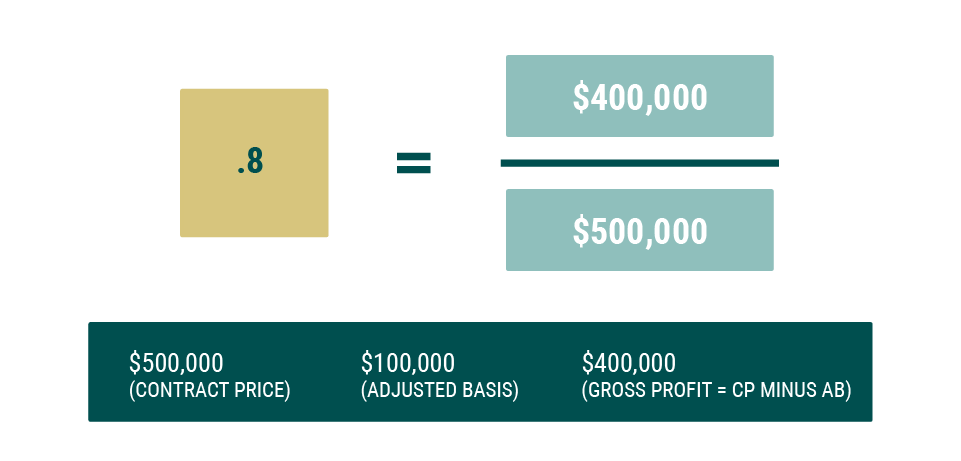

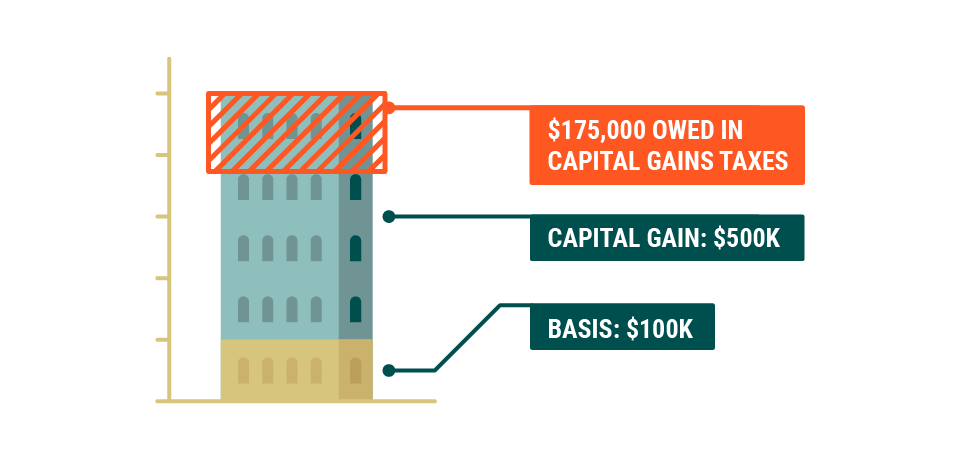

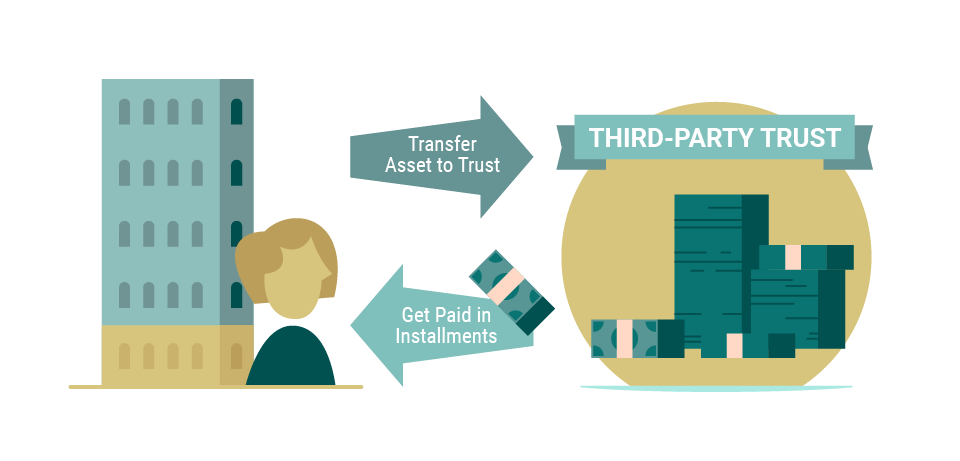

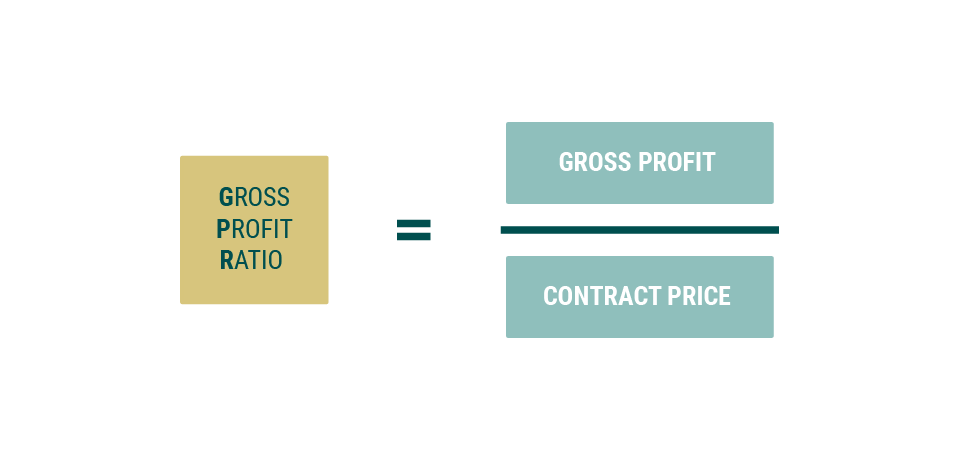

Typically when appreciated property is sold the gain is taxable. A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on assets sold using the installment method proscribed in IRC 453. All the deferred sales trust is a manufactured installment sale and its based upon a Tax Code called IRC 453 which goes back to the 1920s.

A couple of possible pitfalls with deferred sales trusts include. In simplest words if you sell a property for 1 million using the installment method of sale the buyer will typically pay some amount of down payment and pay the rest of the. If a deferred sales trust is improperly managed and the IRS chooses to investigate it is possible that the trust could be designated as a sham trust If a trust is labeled a sham by the IRS the income from the initial sale is taxed as though the trust did not.

The tax on this gain can generally be deferred or spread out with a sale on installment note. Such tax deferral is not possible when the buyer pays the. His company aims to help people defer capital gains tax on the sale of their highly appreciated assets do away with the 1031 exchange and save time so that they can create and preserve more wealth.

Some QIs promote the use of Deferred Sales Trusts or Monetized. It states that if Michelle is going to sell a 10 million business and she has no basis and no debt and Brett wanted to buy it I could give Michelle a 1 down payment and she could carry back paper. By Rick Durfee April 6 2020.

However after spending time looking at the numbers in detail most sellers discover that the opportunity cost of not implementing the Deferred Sales Trust is substantially higher upfront and over time. A deferred sales trust can be difficult to launch and manage. The problem sometimes with 1031 exchanges are the narrow windows of being able to identify a piece of property.

Deferred Sales Trust Problems Are Avoidable Before deciding to set up a Deferred Sales Trust talk with us about the Tax-Deferred Cash Out. Fees for setting up a deferred sales trust may be higher than those of a 1031 exchange. Utilizing a Deferred Sales Trust investors can defer capital gains taxes over time.

Potential Disadvantages of Deferred Sales Trusts. The Deferred Sales Trust has three basic horizon opportunities to look at. The language in the Trust documents and the purchase documents referred to as the DST Note.

In late September of this year the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who actively assist clients with deferring taxes through Deferred Sales Trusts or Monetized Installment Sales. The Deferred Sales Trust is a Trust that purchases the Sellers property and then resells it to the ultimate buyer. Set-up and maintenance fees can be high as well.

2000 closes 14 no charge IRS audits and hundreds of millions in capital gains tax deferred. Unlike exchange-based tax-deferment methods Deferred Sales Trusts are an instance of a special kind of sale called an installment sale which can be used to defer capital gains. It has also save many failed 1031 exchanges.

The DST utilizes a legal and established method to allow the seller of the property to. It allows the Seller to treat the sale as a Seller-carry back transaction where the buyer pays the purchase price over time. If you own a business or real estate with a large amount of gain and are not selling your property because of capital gain taxes or cant find suitable qualified property exchanges then you may want to consider a Deferred Sales Trust DST.

Replied Jan 11 2020 1832. Deferred Sales Trust DST is not actually a term originating in tax authority The Estate Planning Team c laims a common law trademark on it. This option can provide you with far greater liquidity while deferring capital gains tax for up to 30 years.

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. Most of the clients also choose a lower risk portfolio to invest in since they have 30-40 more invested since the tax is deferred. You can not go back and undo the sale.

The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031 exchange. Sellers who are considering using the Deferred Sales Trust DST occasionally comment that the additional legal fee to set up the DST is too high. 3 Some of the main issues to be addressed in a DST are the use of an indepen dent trustee transfer of the asset ownership without retained interest constructive receipt of the sale proceeds trust distributions trust.

Deferred sales trusts also come with a number of caveats that have the potential to increase investment risk. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now. Bretts experience includes numerous Deferred Sales Trusts Delaware Statutory Trusts 1031 exchanges and 88000000 in closed commercial real.

DST Deferred Sales Trust is a term for which the Estate Planning Team claims a common law trademark not. The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time. Deferred Sales Trusts mean that you have sold your property and recognized your taxable gain but are merely deferring the taxable gain over a period of time into the future.

The grantor only pays c apital gains tax on the principal payments received from the DST thus deferring the taxes due by vir tue of the installment sale.

Capital Gains Tax Solutions Deferred Sales Trust

Capital Gains Tax Solutions Deferred Sales Trust

Latest Episode Of The Clarified Realty Podcast Featuring Richard Hershey Discussing Deferred Sales Trusts Real Estate Investing Trust Words Capital Gains Tax

Deferred Sales Trust The Other Dst

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

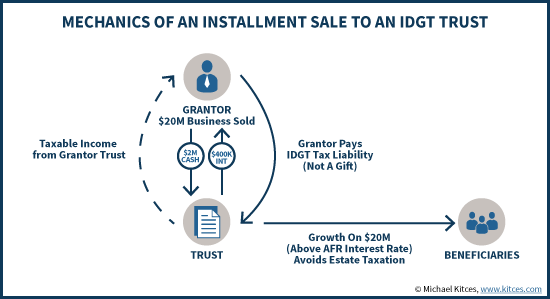

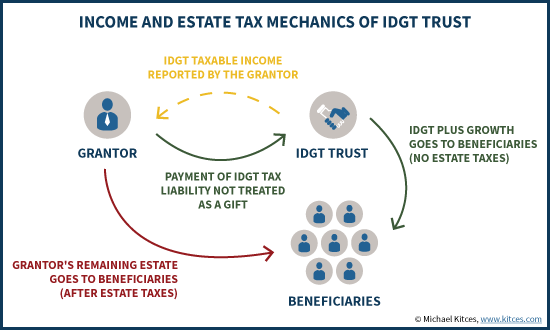

Installment Sale To An Idgt To Reduce Estate Taxes

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Capital Gains Tax Solutions Deferred Sales Trust

Deferring Capital Gains Tax When Selling Art

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust